Policy Proposal: Supporting Startups to Fix “Economic Development”

The U.S. spends $80 billion to $170 billion per year giving large corporations economic incentives to move from place to place within the country while these companies are shown to be net job destroyers over a multi-decade time frame.

Prologue: When I started writing this post, we had just started an economic contraction due to the COVID-19 pandemic. Since then, we have experienced widespread world wide protests due to police brutality. In light of both of these events, the recommendations in this post may seem unimportant but I believe they are even more important if we seek to exit this economic cataclysm quickly and maintain resilient long term economic growth. Further, redirecting improper economic support from established companies and redirecting to the next generation of entrepreneurs will begin to equalize hundreds of years of systematic disadvantage and oppression.

TLDR: The U.S. spends $80 billion to $170 billion per year giving large corporations economic incentives to move from place to place within the country while these companies are shown to be net job destroyers over a multi-decade time frame. The startup companies who actually create the jobs to fill this deficit and create job growth are left out in the cold. Below I show you the data behind this reality and a possible solution to de-escalating our current economic incentives arms race in order to support real jobs growth.

Intro

I’ve spent more than twenty years working on my own startups, helping founders with their startups, and investing in promising startups. At the age of twenty-four I came to this game late by some standards or extremely early by other standards. Thanks to advances in technology and the increased access to the public Internet (fueled by the creation of the web), I discovered an opportunity to create software that could change how the world works.

Over the last twenty plus years I’ve seen the misalignment between what those in power say they want and what they do. Lets first delve into some statistics as to why anyone should even care about startups because, lets face it, they are generally small companies with a handful of employees at most — who cares if they come or go, right?

Job Creation

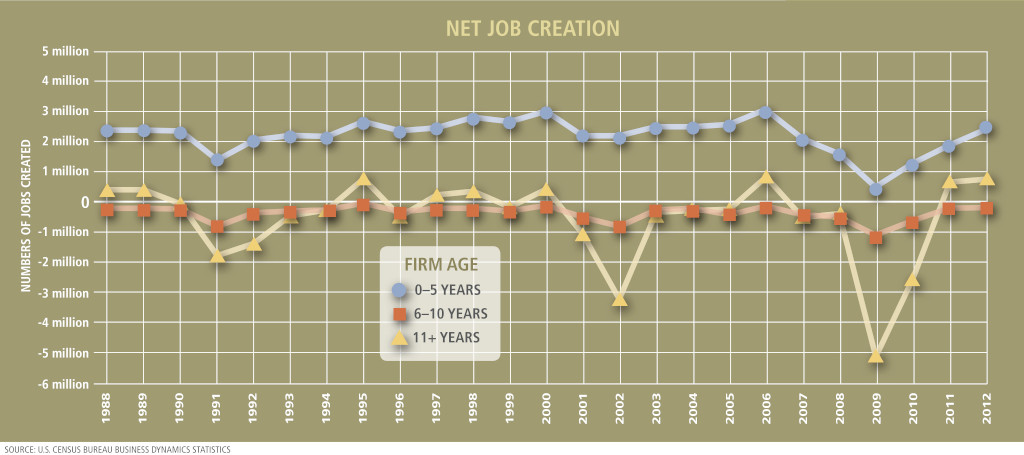

The Kauffman Foundation has undertaken an ongoing analysis of job creation across the country. This report is updated in an ongoing basis to understand where we, as a country, are in terms of job growth.

New businesses account for nearly all net new job creation and almost 20 percent of gross job creation, whereas small businesses do not have a significant impact on job growth when age is accounted for.

Make sure you read that underlined bit. New businesses account for nearly all net new job creation. If it weren’t for new businesses (i.e., startups) then as a country we wouldn’t have nearly any job growth. That is stunning and shows that municipalities should focus on supporting startups if they want to ensure long term economic health of their communities. This isn’t happening — but I’m getting ahead of myself.

Even more stunning is the fact that we have the Small Business Administration but we don’t have any group, at a federal level, solely focused on stimulating startup creation and growth. I’ve seen SBA administrators talk about startups but I have yet to see policy based on stimulating startup activity. Search for “startup” on the SBA site and you’ll see a bunch of releases and announcements of awards given to accelerators but nothing that screams “we have a cohesive plan to grow startups”. Looking at the SBA’s SBIC program, you’ll find only 135 active investors with many states having no applicable investors (including Georgia — two are listed but under the banner of “likely not investing”).

Department of Commerce Secretaries will also give lip service to startups but because supporting startups doesn’t move the needle immediately and would likely not generate press coverage, their focus remains by and large on helping large corporations. This is acutely important because although startup job growth continues, it has fallen for a number of years. Take this comment from a release from the Census Bureau.

In 2015, the nation’s 414,000 startup firms created 2.5 million new jobs according to data from the Census Bureau’s Business Dynamics Statistics. In contrast, this level of startup activity is well below the pre-Great Recession average of 524,000 startup firms and 3.3 million new jobs per year for the period 2002–2006.

If you believe the data (and given the rigor of research from the Kauffman Foundation, it’s hard to dispute it) then our long term health and job growth prospects lay solely at the success of startups. In fact, looking at the chart above, we should ignore companies that are more than 11 years old and let them fend for themselves.

Where Economic Development Dollars Go

But letting older companies fend for themselves isn’t the approach of any economic development group that I’ve ever seen. Politicians will claim they want to support startups but when the rubber meets the road, this isn’t the behavior they project and any support for startups quickly evaporates in the hunt for newsworthy corporate “gets”.

This problem is incredibly large - $80 billion to $170 billion per year. A few years ago the New York Times did an in-depth study of economic incentives paid to companies to relocate to a new municipality. You can examine the data they used for the research here. When there is this much money sloshing around, you know that companies will take advantage of the opportunity and larger companies are more adept at negotiating these opportunities than smaller companies. In fact, those who dole out these incentives will focus on the large companies for the sole reason that these are “accomplishments” that can be publicly announced and receive press coverage (more on this in a moment).

Planet Money did a podcast episode about this exact issue talking about jobs that crossed back and forth between Kansas City, KS and Kansas City, MO. Companies would move across the street - which was across the state line - and collect economic development incentives every few years for doing so. The economic developers (and politicians) would claim a win for their efforts but when the same company moves away a few years later, those same individuals obviously don’t rush to promote the loss or how their prior efforts were for nothing. In the case of the two Kansas City’s, the economic developers reportedly realized they were being played year after year and tried to deescalate the situation by stopping these kinds of incentives.

Imagine the number of startups that could be funded with a $80 billion to $170 billion fund being spent annually. The Pitchbook-NVCA Venture Monitor reports that just over $136 billion was invested into startups in 2019. If the money doled out to companies as incentives was instead used to invest in startups, we would more than double the annual amount of investment in startup stage companies. Granted, a lot of the incentives are not cash but credits or reductions in future taxes to be paid by a company. If these dollars were instead collected and thrown into a fund to invest in startups, this effect would be achieved.

This said, I don’t believe that government should be involved in investing in startups. Government is good at a lot of things but investing is not one of them. I believe there is a better approach to solving this problem than allowing more money to slosh through the startup investment cycle.

The Press Problem

There is one other problem, for which I currently don’t have a solution, that needs to be addressed before we hit upon a solution to solve the above. This is the problem with news coverage.

The unfortunate situation is that news gathering organizations will gladly report stories regarding large corporate news (see all the hoopla around Amazon’s HQ2 announcement and selection - also their demand for large amounts of economic incentives to vie for their attention) but they won’t report on small startups that are just getting started or have hired their first few employees.

It’s easy to see why. When a politician can announce new corporate headquarters moving to their municipality or a new manufacturing plant being built, they tout the hundreds or thousands of jobs that will be “created” and the resulting tax effects that will - in theory, lift up the area. The problem is that often these promises of job creation are not followed up on and often don’t seem to materialize in part or in whole (see the $3 billion in incentives that Foxconn received to build a factory in Wisconsin which they are now not building).

Even if these jobs are “created” in a region, a lot of those jobs are actually stolen from our fellow citizens in other locales. But the press doesn’t talk about how the efforts in one region are putting another region at a disadvantage. Our focus on the winner leaves us blind to what has happened with the other party in the equation.

A Possible Solution

Starting in 2010 and then in 2012 and 2013 I applied to the White House Fellowship. All three times I was selected to be a regional finalist but I was never able to get over the hump to become a national finalist or a fellow. As a part of the application process, I wrote a memo to the President recommending a specific policy proposal. Given my experience as an entrepreneur, I focused on this issue of economic incentives and was able to refine my thinking over the years as I applied to the White House Fellowship program.

I believe that economic incentives to move companies around the country do not accomplish our shared long-term goals of economic stability and growth. I also believe that this corporate welfare distorts market dynamics and protects larger corporations for a longer time period than would have naturally occurred. If these large companies cannot be competitive and innovative on their own merits, then these economic incentives delay the inevitable. Note that I do believe there are occasions where we have rightly used government support to protect industries during market turmoil but these aren’t daily situations (this turmoil is currently occurring with the COVID-19 pandemic and I don’t disagree with the approach to support affected industries).

As an American (or a citizen of any country), you should view these types of economic incentives as hurtful to the overall country and economy. Taking companies and jobs from other citizens just to enrich your local area may seem like a win in the short run but in the long run, having other citizens in your own country at a disadvantage is detrimental to overall economic growth. A rising tide lifts all boats but this type of activity is like damming up a part of the lake in order to benefit a few boat owners.

What I propose is a de-escalation of the economic incentive wars by a voluntary program funded by the federal government. Any governed location - a town, city, county, or state - would be eligible to join the program and would pledge to discontinue offering economic incentives to companies and instead focus their efforts on growing jobs within companies that were less than 5 years old. In exchange, the federal government would remit the total individual federal income tax generated from the individuals taking these new jobs for a period of 12 months or less if the job does not survive for the entire 12 month period. If the job happens to move to another geographic location during that 12 month period but still survives as a job, then the originating location would receive the entire 12 month period of federal income tax generated from that job.

The tax revenue generated and remitted to the smallest participating entity (state, county, or city/town) would be given with no strings attached and complete local autonomy to use the funds as deemed appropriate. This approach sweetens the pot to allow local officials to determine what their budgetary priorities are for further economic development. But if any participating area provides even one dollar of economic incentives to a corporation - large or small - to retain that company or woo them from another geographic location, then that area would be no longer eligible to receive a federal income tax rebate for any jobs created for a twelve month period.

Conclusion

I believe that there is a way to redirect the large amounts of “economic development incentives” that are given out to the benefit of large corporations and instead use them for real proven job development and growth. What will be required is incentives at a federal level to incentivize proper behavior which will have a cascade of good effects including municipalities having more available funding to improve their communities making their regions even more attractive to employers - small and large.

And if making a region more attractive to employers is the whole point of economic development anyways, why wouldn’t we do this?

Thanks

Thanks go out to a number of folks who reviewed this post before I hit publish - Rob Kischuk, Jeff Hilimire, Joey Womack, Adam Walker, my wife, and my kids.